Commitment of Traders Report

Contents:

It’s absolutely essential that all the explanations provided above are adjusted to the circumstances of events present in the market. This means that any major fundamental release, namely central bank policy meetings, geopolitical events or economic data, may distort the analysis of the CoT report as players reassess their exposure in the market. The chart is made up of weekly report data for a specific currency that can be changed in the bottom left corner of the chart. This allows us to better understand what other traders are doing, therefore, predicting what the current market situation/sentiment is.

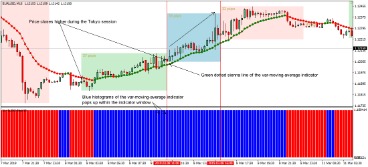

The CFTC receives the data from the reporting firms on Wednesday morning and then corrects and verifies the data for release by Friday afternoon. Due to legal restraints , the CFTC does not publish information on how individual traders are classified in the COT reports. This group of traders are considered of the small guy or one lot crowd. This groups of traders are also usually seen as the group which are the most ill-informed. Oanda provides a free COT chart which includes speculator positioning and Open Interest. In this chart example, you can see the number of large speculators who are both long and short are represented directly below the actual price chart.

In this case speculators holding contracts with the expectation of price increasing sold to commercial buyers who now hold these long contracts as they expect price to fall. Open interest has not changed but the players expectations on what price will do has. Well, futures contracts are exactly that, a contract that is to be settled in the future. Two parties get together and agree to make a transaction in the future at a price agreed upon today.

Commitment of traders report (COT)

The inverse relationship of these 2 groups illustrated in this chart confirms that speculators and commercial traders take opposite positions. The forex market is an over-the-counter market so brokers and dealers negotiate directly with one another because there is no central exchange or clearing house. The COT Report shows approximately 70 – 90% of open positions at futures markets. As a result, a classic bullish set-up for a given market would be when large traders are net long and small traders are net short. The market will be in a weakened bullish set-up “if” the two-week trend in the large trader position is down, or in other words, if the funds are in the process of liquidating their net long position. The larger the net short position of the small trader and the extent that small traders are holding a position “against” the trend are factors which will add to the bullishness of the report.

CFTC Announces Postponement of Commitments of Traders Report … – Commodity Futures Trading Commission

CFTC Announces Postponement of Commitments of Traders Report ….

Posted: Thu, 16 Feb 2023 08:00:00 GMT [source]

Moreover, managed funds do not appear to have reached a sentiment extreme, so perhaps gold can make a daily close above $2,000 should it retain its safe-haven status amidst the current concerns of a banking and liquidity crisis. Leveraged Funds – typically ‘buy-side’ and include hedge funds and money managers such as CTAs and CPOs or unregistered funds as identified by the CFTC. Find the approximate amount of currency units to buy or sell so you can control your maximum risk per position. These are institutional investors, including pension funds, endowments, insurance companies, mutual funds and those portfolio/investment managers whose clients are predominantly institutional.

What Is The Commitment of Traders Report?

These can be an easy way to define investor sentiment and to understand the strength of the underlying trend. The COT report can be used in the same way that you might use a traditional technical indicator that only analyzes price and time. For example, we can apply filters to the report in order to understand not just whether traders are net long or short but whether they are becoming more or less bullish and bearish.

Click to enlargeIf price is increasing and so is open interest, it suggests that price movement is being fueled by new contracts and that it is a bullish signal indicating a healthy trend. Similarly if price is decreasing and open interest is rising, again, this move is fueled by new contracts and it is a bearish signal. Notice that there are actually more short positions during this obvious up-trend than their are long positions. The Commitment of Traders is a great tool to help you understand the market sentiment, but this report itself should serve you only as a benefiting advantage to your analysis and there should be a discretion exercised while using it.

Charts and Resources

Short and Long Format of ReportsThe Legacy and Disaggregated reports are available in both a short and long format. Our strategies to get that much needed time to enjoy your family and friends while your trades run No more 9 to 5 work stress. Clearly a great application of using COT data is to assist with trend following and identifying potential turning points but there are numerous other methods of applying Commitment of Traders data. Large Commercial Traders are generally producers such as farmers, or large factories. The confusing part about the large speculators, is that we don’t really know their full intention., why they are long, or why they are short.

With this knowledge the trader has the ability to trigger a trade exit or entry. The COT report is a strong analytical tool because it offers updated information related to every futures markets. In addition, the COT report is readily available on the most frequently traded futures contracts, which is generally the prompt contract. For instance, the COT report is available on currency contracts which allow COT analysis in currencies. The information released by the CFTC is somewhat cryptic, which makes learning how to read the COT report, a minor challenge.

Forex Trading Account Types – IndiaCSR

Forex Trading Account Types.

Posted: Fri, 31 Mar 2023 05:03:46 GMT [source]

Open interest is the answer, as it’s a measure closely linked to liquidity. Remember, open interest is the total number of outstanding contracts, while volumes are the total transactions that took place. This document comprises a handy personal notebook, where I annotate the most recent changes in positioning in order to assist my weekly analysis. The involvement of commercials and their aggressive changes in positioning represent another important signal for a potential change in bias. Spot forex is non-transparent vs. regulated and transparent futures and options, allowing us to extract critical information.

Forex commitment of traders reports are based on the corresponding futures contracts traded on the Chicago Mercantile Exchange. They are purchasing financial instruments with the expectation that it will become more valuable or profitable in the near future. They have no need for the foreign currency but they are trading it for future profits. They buy when they determine the price to be low with the hope that its value will increase so they can sell it at a higher value for a profit. This would mean loss to company ‘A’ through the currency depreciation as one currency note say worth ten dollars today may be worth five dollars tomorrow through the currency loss of value. To counter this, the trader for company ‘A’ needs to hedge against such depreciation.

The Legacy CFTC Report

Is there any interest/money left to fuel the trend or is time begin locking some profits or looking for signs of reversals. We’ve come to the end of this handy guide to interpret future market dynamics based on the most recent market positioning by the smart money. What’s more, the price context is also important and we must always reflect on whether the market is on a trend or trapped in range conditions.

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth-164×164.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-KGbpfjN6MCw5vdqR.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/09/image-Le61UcsVFpXaSECm.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

Clearing members, commitment of traders forex commission merchants, and foreign brokers file daily reports with the Commission. Those reports show the futures and option positions of traders that hold positions above specific reporting levels set by CFTC regulations. The aggregate of all traders’ positions reported to the Commission usually represents 70 to 90 percent of the total open interest in any given market. From time to time, the Commission will raise or lower the reporting levels in specific markets to strike a balance between collecting sufficient information to oversee the markets and minimizing the reporting burden on the futures industry.

COT Report Trading Strategy

In the video I will show you an example of the net position held by these large traders in the EUR/USD at the time it was recorded. Currency COT charts are particularly useful as they can be used to infer sentiment in related markets. For example, a falling USD/CAD is likely bullish for oil while a falling AUD/USD is probably bad for gold.

The long https://g-markets.net/, in addition to the information in the short report, groups the data by crop year, where appropriate, and shows the concentration of positions held by the largest four and eight traders. When graphically shown on charts, you actually see what is referred to as the Net Traders Positions which is the actual difference between the number of long positions held by each group minus the number of short positions. Thus a positive number means they hold more long positions than short and vice versa.

When the new signal comes, after the closing, the number of bars between the… Hello there, With this script, you can see CFTC COT Non Commercial and Commercial Positions together. This way, you can analyze net values greater than 0 and smaller, as well as very dense and very shallow positions of producers and speculators. Green – Non Commercials – Speculators Red – Commercials – Producers This script is multi time-frame and… In fact, many investors have lost a lot of money by following these sentiments. Before entering, exiting or holding a particular asset, it is important to conduct a good analysis, based on the fundamental or technical indicators.

If this happens there is a significant chance that the farmer would make a tremendous profit on his crop. However, the opposite could take place and soybean process move lower which would cause the farmer to take substantial losses. Again, for many farmers and agricultural commercials, hedging is about reducing risk while attempting to profit as much as possible on the crop yield. Some interactive charts are a good place to start by scrolling through price and positioning data to get a feel for the relationship.