The Accounting Equation

Content

- How to Calculate the Total of Unrestricted & Restricted Retained Earnings

- Common Stock and Additional Paid-In Capital (APIC)

- Understanding Stockholders’ Equity

- Reporting Stockholders’ Equity

- How to Calculate Return on Investment for Small Business Investors

- What Is Stockholders’ Equity? Everything You Need to Know

- What Is Stockholders’ Equity?

Understand what the accounting equation is, learn the elements of the basic accounting equation, and see examples. Selling a depreciable asset for a gain results in an increase in both stockholders’ equity and assets. Capital stock outstanding is the number of authorized shares of stock that have been issued and that are still currently held by stockholders. The stockholders’ equity section begins with paid-in capital. The portion of stockholders’ equity that can be used for dividends is referred to as legal capital.

Usually, this claim is only relevant if a company gets liquidated. Stockholders’ equity may include various components, including capital, paid-in surplus, and retained earnings. The formula for stockholders’ equity comes from the accounting equation.

How to Calculate the Total of Unrestricted & Restricted Retained Earnings

If your total assets also equal $600,000, your balance sheet is properly balanced. Stockholders’ equity also represents a company’s net worth. It appears on the balance sheet as a separate section aside from assets and liabilities. However, it may not appear under the same term for all companies. Sometimes, companies also term it owners’ equity or shareholders’ equity. Despite the different names, the underlying representation remains the same.

- He equity of the shareholders is the difference between the total assets and the total liabilities.

- To form a corporation, a business needs to file paperwork called articles of incorporation with the state in which it will be operating.

- These are not yet distributed to the stockholders and retained by the company for investing in the business.

- Often referred to as paid-in capital, the “Common Stock” line item on the balance sheet consists of all contributions made by the company’s equity shareholders.

- Investment advisory services are only provided to investors who become Stash Clients pursuant to a written Advisory Agreement.

- This compensation may impact how and where listings appear.

For example, preferred shareholders may be entitled to receive dividends before common shareholders. Preferred shareholders may also have preference over common shareholders in the event of a liquidation. Additional Paid-in CapitalAdditional paid-in capital or capital surplus is the company’s excess amount received over and above the par value of shares from the investors during an IPO. It is the profit a company gets when it issues the stock for the first time in the open market. The changes which occurred in stockholders’ equity during the accounting period are reported in the corporation’s statement of stockholders’ equity. To calculate retained earnings, the beginning retained earnings balance is added to the net income or loss and then dividend payouts are subtracted.

Common Stock and Additional Paid-In Capital (APIC)

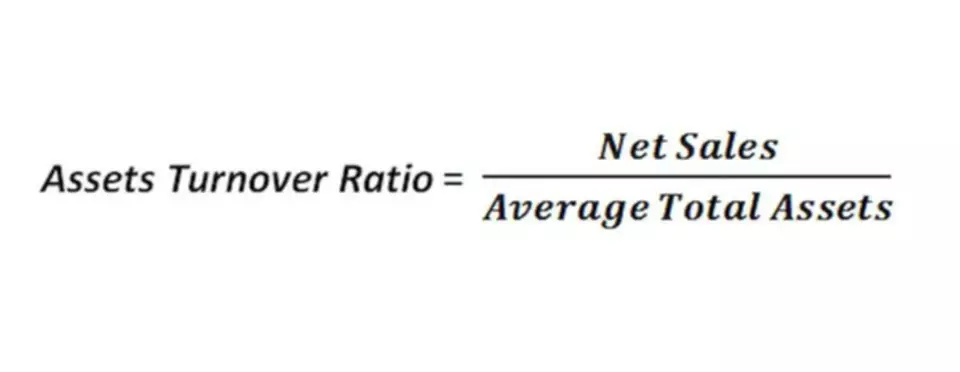

Identify the different methods of calculating the statement of stockholders equity example to equity ratio. The return on equity is a ratio of net income to equity. Nothing on this website should be considered an offer, solicitation of an offer, tax, legal, or investment advice to buy or sell securities. Any historical returns, expected returns or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings are for illustrative purposes only and are not investment recommendations.

First, add up paid-in capital, retained earnings, and accumulated comprehensive income. Owner’s equity must balance with Assets – Liabilities.RCL’s assets total $985,000 and its liabilities total $700,000. Subtracting liabilities from assets yields owner’s equity of $285,000. These figures must match — “balancing” the accounting equation — before the business can close its books for the period ending December 31, 2021.